| Last Week in Review: Inflation is heating up, but what does that mean for home loan rates?

Forecast for the Week: Thursday will be an especially busy day when it comes to reports this week, with news on jobs, housing, and manufacturing. View: Ever experience “brain fog?” Check out three great tips for boosting your brainpower. |

| Last Week in Review |

| “Is the glass half empty… or half full?” That question is one many people are debating when it comes to our economy – yes, the economy is still sluggish… but the slow recovery has helped home loan rates improve. So what developed last week…and what was the impact on home loan rates? Let’s take a deeper look.

First, on the inflation front: 6.8%…that’s the current year-over-year rate of Producer or Wholesale inflation. And that is hot – very hot! And while Producer or Wholesale inflation doesn’t always get passed onto the consumer as evidenced by the relatively benign Consumer Price Index (CPI) inflation readings, at some point one of two things must happen.

The takeaway here: One of the Fed’s goals for their second round of Quantitative Easing (QE2) was to create inflation and avoid deflation in the hopes of strengthening our economic recovery. It appears that they have been somewhat successful in this goal, as the risks for deflation have somewhat abated. But remember, inflation is the arch enemy of Bonds and home loan rates. If inflation continues to heat up, this could hinder further improvement in home loan rates. It’s also important to note that inflation in China is also on the rise, and inflation abroad becomes inflation here in the US as we import so many items from China. China’s buying of our debt has helped keep our home loan rates relatively low for a long time. Home loan rates would likely move higher if China not only slows buying, but were to start selling some of their near $900 Billion worth of U.S. government debt holdings.  And speaking of our debt, Republicans in the U.S. House of Representatives are increasingly dismissive of Treasury Secretary Tim Geithner’s warnings that Congress must raise the debt limit prior to August 2nd or risk economic “catastrophe.” This will be an important development to watch in the weeks to come. The bottom line is that, on the glass half full side of things, home loan rates still remain near some of the best levels we’ve seen this year. If you have been thinking about purchasing or refinancing a home, call or email me to learn more about why now is a great time to benefit from today’s historically low rates. Or forward this newsletter on to someone you know who may benefit. |

| Forecast for the Week |

|

This week, Thursday will be an especially busy day when it comes to economic reports. Be sure to look for:

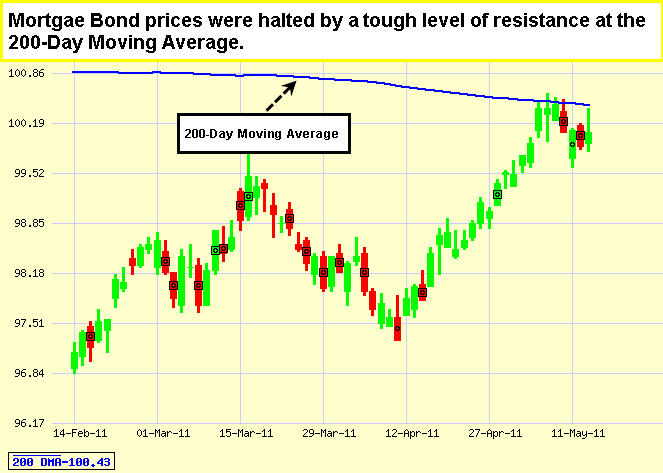

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, Bonds and home loan rates were unable to improve past an important technical level and on the hot inflation news. I’ll be watching closely this week to see if Bonds and rates can break through this resistance and improve.

———————–

Chart: Fannie Mae 4.0% Mortgage Bond (Friday May 13, 2011)

|

| The Mortgage Market Guide View… |

| Boost Your Brainpower – and Happiness – with 3 Simple Steps

It’s easy to believe that your intelligence is set, meaning there’s no way to “boost” your brainpower. However, many scientific studies have proven the exact opposite. A combination of lifestyle adjustments and mental exercises has been shown to not only increase intelligence, but also to improve general brain health and help prevent disorders associated with aging, such as Alzheimer’s disease. According to most neurologists, the key is to stay mentally active, despite your age. The brain is a complex organ, able to create new connections between nerve cells when it is properly stimulated. These connections lend themselves to optimal brain function and increased intelligence. Whether you’re a Generation Xer, a baby boomer, or an octogenarian, the following tips can help boost your mental activity and increase your intelligence: 1. Keep Memorizing. There is no shortage of contemporary studies that show a powerful correlation between a strong working memory and overall intelligence. A good memory has also been shown to slow down mental aging. Ergo, memorizing almost anything is one of the best exercises you can give your brain. Start small by memorizing your shopping list or your daily schedule. Step it up a notch and memorize a poem or two. Take it to another level by learning a musical instrument or a new language. Doing any of these exercises can potentially lead to quick and substantial improvement in your mental sharpness. 2. Get a Hobby. Gardening, bird watching, collecting, flying model airplanes, etc.; taking on any new hobby is good for mental stimulation as well as your overall mood. Finding activities you really enjoy allows you to learn and have fun, simultaneously. It provides both an escape and a passion. All of these traits are components to living a happy and rewarding life, and remaining mentally sharp. 3. Challenge Yourself. One enemy of intelligence and mental sharpness is our propensity to fall into overly rigid, daily patterns. It is one thing to keep a schedule or to plan out the events of your day. What we’re talking about is having the exact same routine, nearly every day. Falling into rigid patterns promotes mental passivity, or the opposite of stimulation. So try mixing things up a bit. Challenge yourself by participating in new activities. Join a softball league, a reading club, or even a theater group. At the very least, play around with your daily schedule. The point is that too much regimen can dull the senses. Start implementing these easy steps today to bring sharpness, clarity, and happiness into your life!

————————–

Economic Calendar for the Week of May 16-20, 2011 Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise. Economic Calendar for the Week of May 16 – May 20

|

|

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors.

|