This Issue ![]()

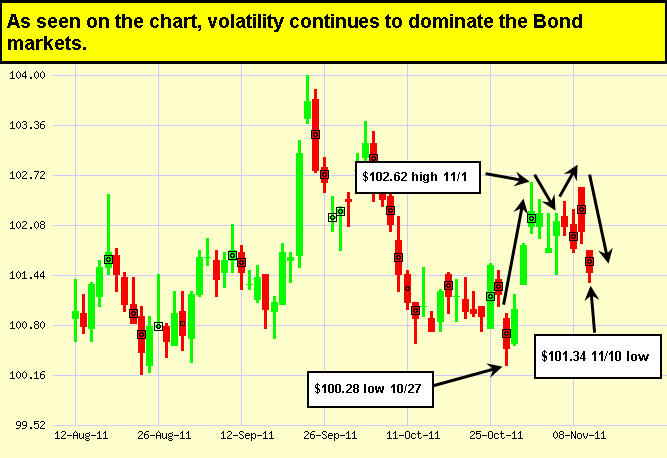

| Last Week in Review: The Bond markets may have been closed Friday for Veterans Day, but there was plenty of news before then to keep the volatility churning.

Forecast for the Week: A slew of reports are ahead, with news on inflation, manufacturing, retail sales and more. View: The flu is nothing to sneeze at. Learn how you can stay up-to-date on outbreaks near you. |

| Last Week in Review |

“Should I stay or should I go now?” The Clash.  And last week, Greece’s Prime Minister George Papandreou announced his resignation, a move seen as a way for new government to step in and implement the Euro rescue plan, thereby securing the financing necessary for Greece to avoid default. But that’s not the only news story making headlines last week. Read on for the details…and what they could mean for home loan rates. And last week, Greece’s Prime Minister George Papandreou announced his resignation, a move seen as a way for new government to step in and implement the Euro rescue plan, thereby securing the financing necessary for Greece to avoid default. But that’s not the only news story making headlines last week. Read on for the details…and what they could mean for home loan rates.

The European crisis that has been lingering for 18 months continues to develop…and it’s not over yet. Lucas Papademos was named as interim Prime Minister of Greece. During his eight years with Greece’s Central Bank, he helped the country achieve very strong economic growth rates. But let’s not cue the sunset, happy music, and production credits just yet. Greece continues to be a very volatile situation, and continued uncertainty could once again push investors back into the US Dollar and US Bonds…helping home loan rates in the process. In addition, as the soap opera in Greece continues, eyes have turned squarely towards Italy, whose Bonds yields have spiked on growing concern it is the next Greece. Italy is not in the same dire situation as Greece yet, but their economy is far larger–the world’s 7th largest, in fact–and a debt crisis in that region will be much more difficult to contain. To add to the Italian uncertainty, Italy’s Prime Minister Silvio Berlusconi is under heavy pressure to resign for a variety of scandalous reasons. Here at home, another story to watch came on the words from Fed Chairman Ben Bernanke, who stated that the Fed has “considerable latitude” to choose its long-term inflation goal. Although Bernanke didn’t elaborate on specifics, the gist of his comment is that the Fed may tolerate higher inflation for a period of time in an attempt to help the economy recover and improve the employment sector. Remember, the Fed is charged with a dual mandate of (1) controlling inflation as well as (2) supporting job creation. While inflation remains close to the Fed’s target range, unemployment is nowhere near where the Fed would want to see it, which is between 5% and 6%. So it appears the Fed may make decisions in the future to improve employment, possibly at the slight expense to inflation. This is important because inflation is the archenemy of Bonds and home loan rates. So any increase in inflation could negatively impact home loan rates. The bottom line is that now remains a great time to purchase or refinance a home, as home loan rates are still near historic lows. Let me know if I can answer any questions at all for you or your clients.

|

| Forecast for the Week |

|

The economic calendar was extremely light last week, but look out this week! The markets are set for a slew of reports that will give us a look at the economy across many sectors.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, the markets continue to be volatile, though home loan rates are still near historic lows. As always, I’ll be monitoring this situation closely. Chart: Fannie Mae 3.5% Mortgage Bond (Friday Nov 11, 2011)

|

| The Mortgage Market Guide View… |

| A Flu Outbreak Near You?

It’s that time of year when we turn our attention to the winter season. While there are many things to look forward to such as the holidays, many of us–including you, your clients, or your friends–may also start to worry about the flu. And the cost of the season is nothing to sneeze at! Did you know that Americans spend approximately $4 Billion on over-the-counter cold and flu remedies? That’s not even factoring in how much time and productivity is lost on sick-time in the workplace, or co-pays for doctor visits and prescriptions. But now there’s a way you can stay up-to-date on the latest flu information in your area. The “Flu Near You” Website The Children’s Hospital Boston has partnered with the American Public Health Association and the Skoll Global Threats Fund to bring you the “Flu Near You” website. On this site, any individual living in the United States who is 13 years of age or older can register to complete brief weekly surveys that may help all of us learn more about the flu. When a case is reported, the map registers a “pin” in the map-and you can even click on that pin to learn more about the symptoms or severity of the case! Now You Can:

The site is completely free to use. And the information on the site will be available to public health officials, researchers, disaster planning organizations and anyone else who may find this information useful. So consider registering and using this site today Want More Local Health Information? In addition to the Flu Near You map, the Children’s Hospital Boston also administers a Healthmap that features information about other health concerns or outbreaks in your community and around the world. So if you’re concerned about the upcoming flu season or other health concerns, take a few minutes to check out the Flu Near You map and the Healthmap. You may even want to consider passing the information on to your friends, family members, or even your clients. Economic Calendar for the Week of November 14 – November 18

|

|

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors.

|