In This Issue ![]()

| Last Week in Review: The Jobs Report for April is in, but what did the news reveal about our economy?

Forecast for the Week: A quiet week is ahead, but an important inflation report will be released. View: If you’ve ever forgotten the name of an important colleague or client, have no fear. These tips can help. |

| Last Week in Review |

| Take this job and love it. And the Labor Department’s Jobs Report for April showed that fewer than expected people are able to do this, as fewer than expected jobs were created. Read on for details and what they mean for home loan rates.

The unemployment rate dropped a tick to 8.1% — the lowest since January 2009. However, the decline was mainly due to the labor force shrinking by 300,000, rather than by robust job growth. And as expected, we are starting to hear more and more about the Labor Force Participation Rate (LFPR). The LFPR dropped to 63.6, the lowest ratio since December 1981. Why is this important? The LFPR gives us a clear read of who is working and who is not. And if someone is not participating, then they are probably receiving some sort of social security or unemployment insurance. The bottom line is that it is tough to pay down debt when there are not enough people participating in the labor force. Overall the Jobs Report was underwhelming and, unfortunately, further accommodative monetary policy or even more Bond buying (known as Quantitative Easing or QE3) will have a very limited effect on job growth. What’s more, the debt drama in Europe continues to escalate, as both Italy and Germany reported higher than expected unemployment rates, while Spain has slipped into its second recession since the financial crisis. The events in Europe and potential softening of our economy have resulted in home loan rates remaining near historic lows. That means now continues to be a great time to purchase or refinance a home. Let me know if I can answer any questions at all for you or your clients.

|

| Forecast for the Week |

|

After two weeks featuring a slew of economic reports, this week’s calendar is light. But that doesn’t mean there won’t be a battle for investing dollars in the Stock and Bond markets!

With so few economic reports this week, market players will be focusing in on the ongoing debt crisis in Europe, earnings reports and how the $66 Billion in Treasury Notes and Bonds will be received. All three of those news items could move Bonds and home loan rates this week. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on. When you see these Bond prices moving higher, it means home loan rates are improving — and when they are moving lower, home loan rates are getting worse. To go one step further — a red “candle” means that MBS worsened during the day, while a green “candle” means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning. As you can see in the chart below, Bonds and home loan rates reached record best levels after last week’s Jobs Report. I’ll be monitoring the markets closely this week to see what happens next. Chart: Fannie Mae 3.5% Mortgage Bond (Friday May 04, 2012)

|

| The Mortgage Market Guide View… |

| It Pays to Have a Good Memory

In today’s housing market, it can pay (quite literally) to have a good memory. That’s because a good memory can help you stand out from the competition — especially when you’re networking and trying to remember names. Unfortunately, many of us have trouble remembering the name of someone two minutes after we shake her hand. If that sounds like you, don’t worry… you’re not alone. It’s actually an extremely common occurrence for many people. The good news is there are a number of simple, practical steps you can take to improve your memory now and long into the future. Here are just two of the great tips for proactively strengthening your memory. Tip #1: Neurobic Exercise You know all about the wonderful effects aerobic exercise has on the heart, but have you heard of neurobic exercise for the brain? According to Lawrence Katz, co-author of Keep Your Brain Alive: 83 Neurobic Exercises, the best exercise for the brain is to force it to form “new patterns of association” or new pathways. In other words, challenge your brain every day. Take it off autopilot and make it relearn or create new associations with the most routine activities of your day. Katz’s book offers numerous examples of small changes you can make to activate your brain, including: brushing your teeth with the other hand; taking an alternative route to work; moving your wastebasket to the other side of your desk; closing your eyes while putting your key in and unlocking the front door; and changing where you and your family members sit at the dinner table. So if you feel like your memory might be starting to slip a bit, try some of these simple neurobic exercises today! Tip #2: Mnemonic Drilling There are actually three steps or stages of memorization: acquisition, consolidation, and retrieval. That means, once we acquire new information, like someone’s name for instance, the way in which we consolidate that data will directly affect how well we’re able to retrieve it from memory. Whether you’re a visual or auditory type of learner, there are many mnemonic devices that can help you to better organize or consolidate the new information that you need to recall. Here’s an example of simple steps that might help: First, associate the data you want to remember with common images. For instance, let’s say you meet someone named Jennifer Green. Imagine Jennifer playing golf, or picture her wearing all green clothes, or imagine her face painted completely green. Second, think of associations you can use to help you remember this person. For instance, link Jennifer to the quality that best fits her personality (use alliteration and rhymes whenever possible): Jolly Jennifer Green. Finally, connect sound to your memory by saying the name aloud. Do this regularly and, before you know it, you’ll never forget anyone’s name again! And that can give you a nice advantage in networking and communicating with clients! Economic Calendar for the Week of May 07 – May 11

|

|

The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors.

|

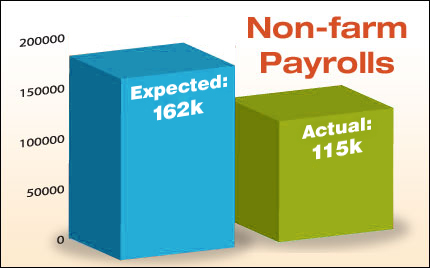

The Jobs Report showed that 115,000 jobs were created in April, with 130,000 private sector jobs offsetting government job losses. This number was a disappointment and below expectations. The only silver lining in the report were upward revisions to the previous month’s readings which added 53,000 more jobs than what was previously reported.

The Jobs Report showed that 115,000 jobs were created in April, with 130,000 private sector jobs offsetting government job losses. This number was a disappointment and below expectations. The only silver lining in the report were upward revisions to the previous month’s readings which added 53,000 more jobs than what was previously reported.