In This Issue ![]()

| Last Week in Review: There was more news that our economy may be slowing, but what does that mean for home loan rates?

Forecast for the Week: The economic calendar heats up, with news on retail sales, manufacturing, inflation and more. View: Maintaining a budget is especially important in today’s economic environment. Share these easy-to-follow tips with your clients, colleagues, and family members. |

| Last Week in Review |

| Slow and steady wins the race. That may be true for certain Olympic events, but when it comes to our economy slowing seems to be the operative word of late. Read on for details and what they mean for home loan rates.

Recession talk has grown in recent days, and some very well respected economists and thinkers believe we are either in a recession already or about to enter one. It is very tough to argue with this notion as the labor market and manufacturing numbers have rolled over in recent months, with those trends likely to continue lower in the face of so much uncertainty here and abroad. In addition, corporate earnings are starting to come out and companies are reporting numbers below already lowered guidance and citing uncertainty into the future. So what does all of this mean for home loan rates? Recessions are deflationary (i.e. consumer prices moving lower) and deflation is good for Bonds as the fixed interest payment to the end investor goes further if consumer prices are moving lower. This means deflation is also good for home loan rates, as rates are tied to Mortgage Bonds. If the economic data continues to be weak, the Fed will likely do another round of Bond buying, known as Quantitative Easing or QE3 – and in fact, the Fed Minutes for the June Meeting showed that a couple members had an appetite for more easing, but there was no consensus. Remember that additional hints of QE3 could initially push Stock prices higher, shifting cash out of the Bond trade and hurting home loan rates in the process. I will continue to monitor this situation closely. The bottom line is that now continues to be a great time to purchase or refinance a home, as home loan rates continue to reach historic lows. Let me know if I can answer any questions at all for you or your clients. |

| Forecast for the Week |

|

The economic calendar heats up this week. Couple that with the heart of earnings season and you have a recipe that could easily move markets.

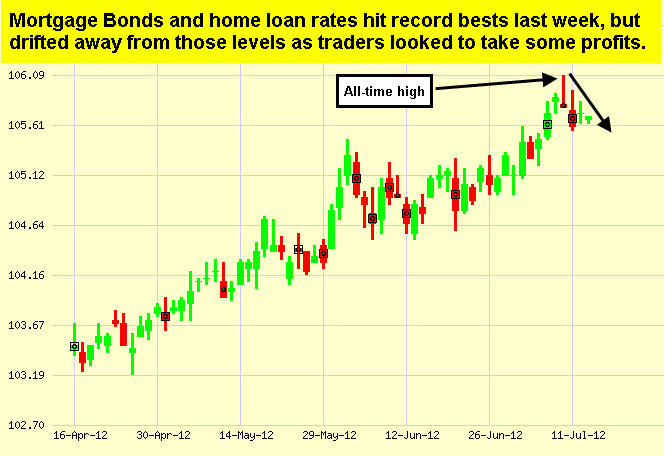

In addition to those reports, earnings season is well underway. That means investors will react to the data within minutes of the release. Of course, if the numbers are weak, Stocks will most likely tumble and this could support Bonds and home loan rates. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on. When you see these Bond prices moving higher, it means home loan rates are improving — and when they are moving lower, home loan rates are getting worse. To go one step further — a red “candle” means that MBS worsened during the day, while a green “candle” means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning. As you can see in the chart below, Bonds and home loan rates continue to reach record best levels…though they did pull back from their very best levels in the latter part of last week. I will continue to monitor all the news closely to see how home loan rates are impacted. Chart: Fannie Mae 3.5% Mortgage Bond (Friday Jul 13, 2012)

|

| The Mortgage Market Guide View… |

| 3 Steps to Staying on Budget

In today’s economic environment, many people are paying more attention to their monthly budgets than they have in a long time. One of the best ways to reign in your budget is to get a handle on your spending habits. Share the following tips with your clients, colleagues, and family members so they can whittle down unnecessary expenses. These tips can also be applied to evaluating your business costs and expenses. 1. Take inventory. Many people can name their major expenses, but don’t remember all the little expenses that drain their wallets. To help you get a true picture of your spending, try writing down everything you spend money on during the course of a month. That means writing down not only your major expenses, but also those quick trips to the gas station, grocery store, coffee shop, movie theater, fast food restaurants, and so on. Also, if you pay for insurance or another bill on a quarterly basis, write down what the monthly expense equals. 2. Mark down your needs. Once you have all your expenses listed, it’s time to analyze them. The best place to start is by grouping your expenses using highlighters. For example, you may want to use one color to highlight “must haves” like your automobile, life insurance, utility payments and so on. Next, use a different color to highlight items that may be important occasionally, but aren’t required—such as, new clothes for work. Finally, use a different color to highlight unnecessary expenses that are nice, but could easily be cut out, such as mochas from the local coffee house. Now, you can make some purposeful decisions about what you can cut—starting with the easy items and working your way up to the important but not necessary. Don’t forget, it’s not always “either-or.” For instance, you don’t have to cut out mochas altogether; instead, you can cut down to one per week as a special treat after a busy or productive week. 3. Give yourself an allowance. Sticking to your budget is easier if you have no other option. If you have a real spending problem, you may want to give yourself an allowance to live on. For example, try taking out $50 or $70 in cash for each week and putting your credit cards and checkbook in a safe place. That way, when you spend money, you’ll actually see it leave your wallet… which means you’ll see the impact more dramatically. This forces you to make some tough decisions. After all, if you go to lunch on Wednesday, you may not be able to go to dinner on Friday night. It’ll be tough at first. But soon, it will be second nature. Economic Calendar for the Week of July 16 – July 20

|

|

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors.

|

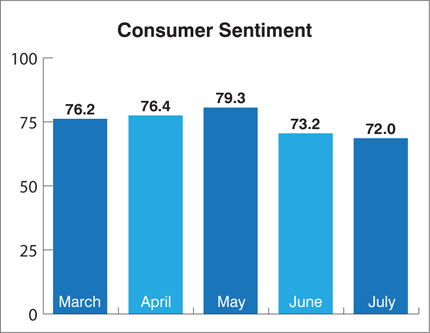

Last week there was more evidence of a slowing U.S. economy, as the National Federation of Independent Businesses stated that its small business optimism index saw its largest one-month drop in two years, falling 3 points to 91.4. The 91.4 number is the lowest level since October. Consumer Sentiment for July also came in at its lowest level this year.

Last week there was more evidence of a slowing U.S. economy, as the National Federation of Independent Businesses stated that its small business optimism index saw its largest one-month drop in two years, falling 3 points to 91.4. The 91.4 number is the lowest level since October. Consumer Sentiment for July also came in at its lowest level this year.