In This Issue ![]()

| Last Week in Review: The Fed announced another round of Quantitative Easing. What does this mean for home loan rates?

Forecast for the Week: A double dose of manufacturing news and a triple dose of housing news are ahead. Plus, how will the markets react to QE3? View: Webcams are being used more and more in business these days. Don’t miss these tips for making the right impression. |

| Last Week in Review |

| Here we go again! Last week, the Fed announced another round of Quantitative Easing (QE3). Read on to learn what QE is, why the Fed announced QE3…and what this means for home loan rates.

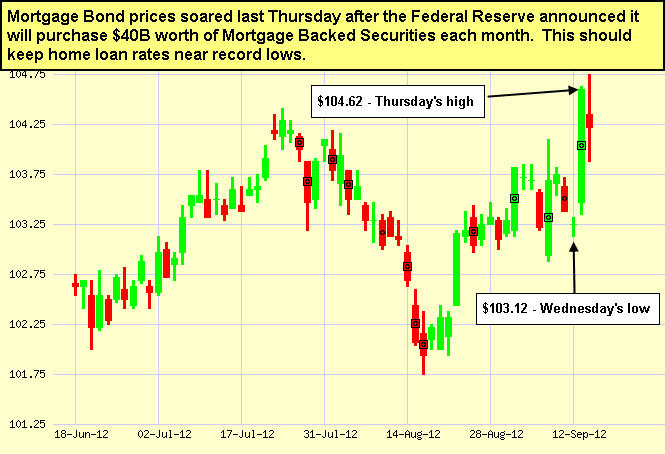

Why did the Fed announce QE3? With our economy still struggling (especially our housing and labor markets) and inflation appearing tame, QE3 was widely expected. But what caught the markets by surprise was the aggressiveness of the Fed’s action. Over the next several months, at the very least the Fed will be buying Mortgage Bonds at an annual rate of nearly $800 Billion. The Fed also noted that QE3 will continue until there is a self-sustainable recovery in our economy, as long as inflation doesn’t rise too high or quickly. Supporting the Fed’s action was August’s tame inflation data at the consumer level. It is important to note that the Producer Price Index (PPI), which measures inflation at the wholesale level, rose to three year highs in August due to the spike in fuel costs and food prices. Rest assured, the Fed will be watching inflation levels carefully over the coming months. What does QE3 mean for home loan rates? The Fed is buying such large amounts of Mortgage Bonds each month to keep home loan rates (which are tied to Mortgage Bonds) near record lows, which they hope will help strengthen our housing market and economy overall. However, as the economy starts to improve and if inflation heats up, Bonds could face some selling pressure…which could impact home loan rates negatively as a result. The bottom line is that home loan rates remain near historic lows and now is a great time to consider a home purchase or refinance. Let me know if I can answer any questions at all for you or your clients. |

| Forecast for the Week |

|

Manufacturing and housing news dominate the economic report calendar this week.

In addition to these reports, all eyes will be watching to see how the markets and home loan rates respond to QE3. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on. When you see these Bond prices moving higher, it means home loan rates are improving — and when they are moving lower, home loan rates are getting worse. To go one step further — a red “candle” means that MBS worsened during the day, while a green “candle” means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning. As you can see in the chart below, Bonds and home loan rates reacted favorably to the Fed’s announcement of QE3. I’ll be watching closely to see how the markets respond this week. Chart: Fannie Mae 3.0% Mortgage Bond (Friday Sep 14, 2012)

|

| The Mortgage Market Guide View… |

| Webcam Tips for Business

Webcams have steadily grown in popularity in businesses across the country. More and more companies are embracing the technology as a cost-effective, timesaving way to record videos for a company website or to conduct meetings. Regardless of how you’re using a webcam in your career, the following information can help you be more successful. 1. Eliminate distractions. When you’re on a webcam, you can be interrupted by the phone ringing, people knocking on your door, and so on. To make sure that doesn’t happen, find a quiet place where you can avoid any distractions. 2. Remove the clutter. A webcam doesn’t just allow people to see you; they can also see into your office. If the background setting looks messy, cluttered, or less than professional, it may taint how you are perceived. So, clean up everything that will be in the background, including those things that are off in the distance. The best advice is to have a clean, simple background setting where only one or two major pieces of office furniture can be seen. 3. Check the lighting. Anyone who’s ever used a webcam realizes that you can sometimes appear pale or tired in an online video. To overcome this problem, you can simply check the lighting. You’ll want the room to be bright, but not so bright that your face is washed out. If you need additional lighting, bring a lamp or two into the room. 4. Maintain eye contact. To make sure you maintain eye contact, look directly at your webcam – rather than another person’s image or a script on your monitor. It may feel awkward at first, but it will appear natural and professional to the person on the other end. 5. Send the right body language. Like in face-to-face communication, your posture and body language are important online. So sit up straight, use simple hand gestures as you talk, and resist the urge to fidget or make a lot of unnecessary movements (like scratching your head or constantly readjusting your seating position). Following those simple steps can help you be more successful the next time you find yourself sitting across from a webcam at your office. Economic Calendar for the Week of September 17 – September 21

|

What is Quantitative Easing? Quantitative Easing is the concept of the Fed becoming a buyer of Treasuries and Bonds to try and stimulate the economy. Oftentimes, the Fed does Quantitative Easing when they are hoping to (1) create inflation and avoid a deflationary economy, (2) lower the unemployment rate, and (3) boost Stock prices.

What is Quantitative Easing? Quantitative Easing is the concept of the Fed becoming a buyer of Treasuries and Bonds to try and stimulate the economy. Oftentimes, the Fed does Quantitative Easing when they are hoping to (1) create inflation and avoid a deflationary economy, (2) lower the unemployment rate, and (3) boost Stock prices.