In This Issue ![]()

| Last Week in Review: It was a volatile week in the markets. Find out what happened to home loan rates.

Forecast for the Week: This week’s calendar is jam-packed, with news on inflation, manufacturing, retail sales, and more. View: Have any clients or colleagues doing back-to-school shopping? Or in the market for electronics yourself? Read (and pass on) the great tips below. |

| Last Week in Review |

| “Where do we go from here?” – Alicia Keys. And after a volatile week in the markets, you may be wondering where Bonds and home loan rates go from here. Read on for details.

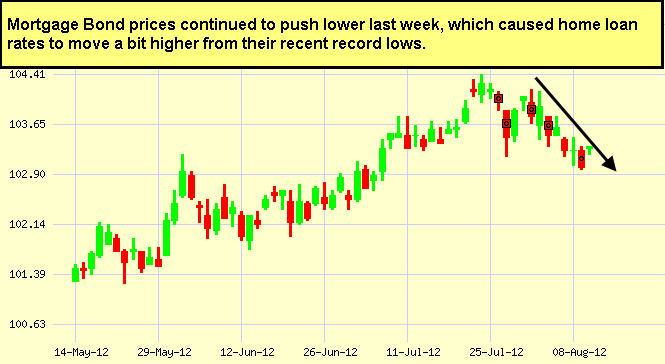

Also of note, the Fed’s Eric Rosengren stated that the current U.S. economic outlook calls for another round of Bond buying (known as Quantitative Easing, or QE3). Remember that once an official announcement about QE3 is made, Bonds and home loan rates could suffer as Stocks would likely rally. So where do Bonds and home loan rates go from here? While Bonds and home loan rates worsened last week due to some optimism out of Europe and a better than expected Jobs Report for July, there are many reasons why Bonds and home loan rates should have better weeks ahead. There is evidence of a weakening economy here in the U.S. For example, the expectations component of the University of Michigan Consumer Sentiment Report came in at 65.6 in July, the lowest reading of 2012. In addition, the ongoing problems in Europe and the upcoming election this fall will bring uncertainty…and Bonds (and therefore home loan rates, which are tied to Mortgage Bonds) typically benefit from uncertainty, as investors see Bonds as a safe haven for their money. Technical trading levels will also be an important factor to watch closely in determining what happens next with Stocks, Bonds, and home loan rates. The bottom line is that now is a great time to consider a home purchase or refinance, as home loan rates remain near historic lows. Let me know if I can answer any questions at all for you or your clients. |

| Forecast for the Week |

|

The markets will have a lot to chew on this week, especially given the packed economic calendar.

In addition, Stock movements will be watched closely. If Stocks continue to rise, it could keep pushing the Bond markets lower–and, in turn, push home loan rates higher. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on. When you see these Bond prices moving higher, it means home loan rates are improving — and when they are moving lower, home loan rates are getting worse. To go one step further — a red “candle” means that MBS worsened during the day, while a green “candle” means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning. As you can see in the chart below, Bonds and home loan rates continued to move from their record levels, but still remain near historic bests. I’ll continue to monitor their movement closely. Chart: Fannie Mae 3.5% Mortgage Bond (Friday Aug 10, 2012)

|

| The Mortgage Market Guide View… |

| How to Save on Back-to-School Electronics

Follow these six tips to cut costs on computers, phones and other devices for students. By Cameron Huddleston, Kiplinger.com Among the most-expensive items on many families’ back-to-school shopping lists are electronics, such as computers, tablets, MP3 players and smart phones. According to a National Retail Federation survey, families are expected to spend about $218, on average, on these items during the back-to-school shopping season this year. Economic Calendar for the Week of August 13 – August 17

|

|

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

|

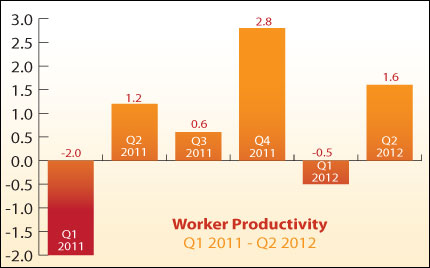

There were only two economic reports released last week, and the news from them was mixed. Productivity rose 1.6% in the 2nd quarter of 2012. Higher productivity signals that companies are squeezing more out of their current employees and may not add workers, which could slow job growth. There was a bit of good news on the labor front, though, as Initial Jobless Claims came in below expectations, declining to 361,000.

There were only two economic reports released last week, and the news from them was mixed. Productivity rose 1.6% in the 2nd quarter of 2012. Higher productivity signals that companies are squeezing more out of their current employees and may not add workers, which could slow job growth. There was a bit of good news on the labor front, though, as Initial Jobless Claims came in below expectations, declining to 361,000.