| In This Issue… |

| Last Week in Review |

| Forecast for the Week |

|

The latter half of the week ahead will hold the heavyweight economic reports. Be watching for:

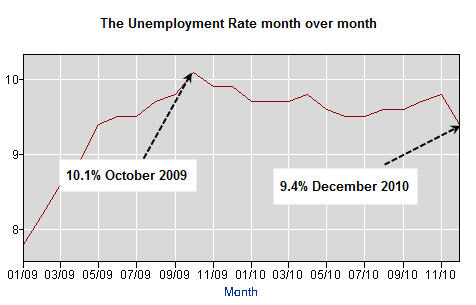

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, Bonds and home loan rates ended the week about the same place as where they began…despite the tune of volatility that was in the air. Now would be a great time to call or email me if you have any questions about your situation!

———————–

Chart: Fannie Mae 4.0% Mortgage Bond (Friday Jan 07, 2011)

|

| The Mortgage Market Guide View… |

| Tax Deadline Extended!

But What If You Need More Time? This year, instead of your tax filing being due on Friday, April 15, you’ll have a few extra days to complete and file your taxes. That means your tax filing isn’t due until Monday, April 18, 2011. The three extra days have been added because of Emancipation Day, which is a little-known Washington, D.C. holiday that celebrates the freeing of slaves in the district. The holiday actually falls on Saturday, April 16 this year, but will officially be observed on Friday, April 15. As a result, the IRS pushed the filing deadline to Monday, April 18 – since the tax code states that filing deadlines can’t fall on Saturdays, Sundays or holidays. Still Need More Time? If you need more time to file your taxes, you can submit Form 4868 for a six-month extension. You can learn more about extensions on the IRS website. Problems Paying? But what do you do if you’ve completed your tax returns only to find out that you owe way more to Uncle Sam than you were expecting – or worse, that your tax bill is more than you can possibly afford to pay right now? Don’t worry. If this is the case, you’re not alone… especially in today’s economy. And, more importantly, you’re not going to jail just for being a little short on cash. Rest assured, the IRS only seeks criminal charges for those who the agency can prove intentionally chose not to file and pay taxes. So, even if you can’t pay your bill right away, file your return on time, and not only will you stay off the IRS’s bad side, you’ll avoid some hefty financial penalties in the process. Penalties and Interest Charges According to the IRS, the penalty for filing late is generally 5% per month, or up to 25% of the total tax amount due. Not to mention interest charges, which the IRS changes quarterly, and which range between 4% and 9%. This interest applies to the unpaid balance, penalties, and to any interest that has been charged to the account as well. If no effort is made to pay back-taxes, the IRS can impose stricter penalties, including levying bank accounts, wages, other income, or taking other assets like houses and cars. A Federal Tax Lien could also be filed, which could ruin your credit history for years to come. The penalty for filing on time but paying late, however, is much lower. If you choose an installment plan to pay your debt, interest will accrue on the unpaid debt amount only. Therefore, when you file your return, pay as much as you can to help cut down the penalties. Delayed Collection If you absolutely cannot pay any part of your tax bill, the IRS may temporarily delay collection until your financial situation improves, although interest and penalties will accrue throughout this time. But this extension is reserved for what the IRS calls “significant hardship.” Your best bet is to talk to a CPA or tax professional if you cannot pay any part of your tax bill. Whatever you do, DON’T just ignore the bill and assume the government will forget about it. Assess the situation, seek help from a tax professional, and make a plan to address the situation.

————————–

Economic Calendar for the Week of January 10-14, 2011 Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise. Economic Calendar for the Week of January 10 – January 14

|

|

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors.

As your trusted advisor, I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

|