In This Issue ![]()

| Last Week in Review: Home loan rates continue to reach record best levels, as uncertainty here and abroad grows.

Forecast for the Week: The second half of the week heats up, with news on the housing market, consumer sentiment, Gross Domestic Product and more. View: Ever feel like you don’t have enough time to focus on important things at the office? Read—and share with your clients, friends, and colleagues—the great tip below. |

| Last Week in Review |

| They say that every cloud has a silver lining. And despite a slew of disappointing economic news last week, home loan rates continue to reach record best levels. Read on for details.

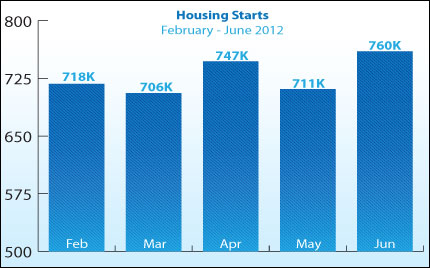

But the economic news wasn’t all negative. Inflation at the consumer level remained tame in July, while Housing Starts for June increased nearly 7% to 760,000. This marks the highest level for housing starts since October 2008. Since home builders don’t start a house unless they are fairly confident it will sell upon its completion, if not before, changes in the rate of housing starts can tell us a lot about demand for homes and the construction outlook. In other important news last week, Fed Chairmen Ben Bernanke was on Capitol Hill delivering his semi-annual testimony before both the Senate and House. He confirmed that our economy is weak, uncertainty in Europe is threatening U.S. growth, and unemployment is stubbornly high. But perhaps more significant was what Bernanke didn’t say: There was no mention or hint of another round of Bond buying (known as Quantitative Easing or QE3) at the next Fed Meeting. It’s important to remember that rumors or hints of QE3 could help Bonds (and thus home loan rates, which are tied to Mortgage Bonds), but once an official announcement is made, Bonds and home loan rates could suffer as Stocks would likely rally. However, the weak economic data here and the continued problems in Europe mean that investors will likely continue to see our Bonds as a safe haven for their money…helping home loan rates in the process. The bottom line is that home loan rates continue to reach historic lows, making now a great time to purchase or refinance a home. Let me know if I can answer any questions at all for you or your clients.

|

| Forecast for the Week |

|

Although economic news this week is rather light, some key reports will be released…and they may impact the markets and home loan rates:

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on. When you see these Bond prices moving higher, it means home loan rates are improving — and when they are moving lower, home loan rates are getting worse. To go one step further — a red “candle” means that MBS worsened during the day, while a green “candle” means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning. As you can see in the chart below, Bonds and home loan rates continue to improve. I’ll be watching closely to see what happens this week. Chart: Fannie Mae 3.5% Mortgage Bond (Friday Jul 20, 2012)

|

| The Mortgage Market Guide View… |

| One Day = 1,440 Minutes

By Jason Womack, Author. Productivity Coach. http://amzn.to/bestbetter Schedule “think” time on your calendar. Start with blocks of 15 minutes. I recommend you schedule five of these sessions over the next week. Consider starting with just one a day. There are two goals for this activity:

If you schedule just one 15-minute block of think time a day, you’ll be able to do it. (I’ve seen too many people try to block out an hour or two, only to have “something come up” that pulls them out for half or even all of that time.) 15 minutes…it’s short enough to find, and long enough to matter!

Economic Calendar for the Week of July 23 – July 27

|

|

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors.

|

The majority of economic reports released last week added to the uncertainty about our economic outlook. Retail Sales fell more than expected while the NY State Manufacturing Index remains at relatively low levels. In addition, the National Association for Business Economics (NABE) reported that the outlook for job growth has fallen due to a weakening economy. The survey revealed that 23% on those polled in July think that US employment will rise over the next six months, down from 39% in April.

The majority of economic reports released last week added to the uncertainty about our economic outlook. Retail Sales fell more than expected while the NY State Manufacturing Index remains at relatively low levels. In addition, the National Association for Business Economics (NABE) reported that the outlook for job growth has fallen due to a weakening economy. The survey revealed that 23% on those polled in July think that US employment will rise over the next six months, down from 39% in April.