In This Issue ![]()

| Last Week in Review: The markets were closed Monday but the rest of the week had its share of good and bad news.

Forecast for the Week: A plethora of economic reports will hit the wires, with news on inflation, manufacturing, the state of the economy and more. View: “Thank you” may be two small words, but they carry a large significance. |

| Last Week in Review |

Every cloud has a silver lining. That popular idiom is one way to look at the headlines last week, both here in the U.S. and overseas. Read on for the details and what they may mean for home loan rates.

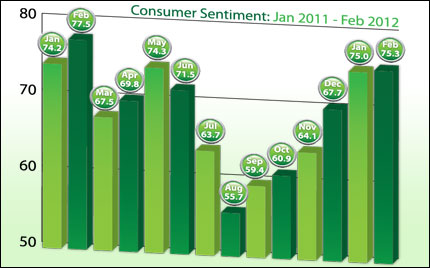

There was good news on Friday as Consumer Sentiment rose to 75.3, which is the best level since February of 2011. However, this news was tempered by the rise in oil prices that we have been seeing. There’s a good side and a bad side to higher oil prices. There was good news on Friday as Consumer Sentiment rose to 75.3, which is the best level since February of 2011. However, this news was tempered by the rise in oil prices that we have been seeing. There’s a good side and a bad side to higher oil prices.On the one hand, high oil prices are very detrimental for the fragile U.S. economy, as consumers have to put more of their discretionary dollars into their gas tanks…meaning they have less to spend elsewhere. High oil prices are also inflationary as the added shipping and material costs apply upward price pressures on Producer or Wholesale goods that either have to be absorbed by the producer, thus hurting profits and the ability to expand or hire. Or the added costs get passed onto to the consumer…a la a rise in consumer inflation. The silver lining is that high oil prices could actually be good news for home loan rates, as the dampening effect on economic growth produces a sluggish economic environment in which Bonds (including Mortgage Bonds, to which home loan rates are tied) thrive. This is an important topic to continue watching in the weeks and months ahead. In silver linings overseas, after seemingly endless negotiations, Greece, investors and central bankers came to an agreement to provide Greece with 130 Billion Euros ($172 Billion) in financial aid. This will help the country fund itself through March and into the future… as long as it institutes economic reform, austerity measures and meets deficit targets. Any deal with Greece will be very tough to implement and a default could still occur…which makes this another important topic to keep close watch on. Between some of this uncertainty from overseas being lifted, a lower unemployment rate, and better than expected economic reports, home loan rates have struggled to improve beyond some of the best levels seen over the past two weeks. But yet another silver lining is that home loan rates remain near historic lows, and now continues to be a great time to purchase or refinance a home. Let me know if I can answer any questions at all for you or your clients. |

| Forecast for the Week |

|

After last week’s holiday-shortened week, there will be plenty of economic reports to watch for.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. The chart below shows Mortgage Backed Securities (MBS), which are the type of Bond that home loan rates are based on. When you see these Bond prices moving higher, it means home loan rates are improving – and when they are moving lower, home loan rates are getting worse. To go one step further – a red “candle” means that MBS worsened during the day, while a green “candle” means MBS improved during the day. Depending on how dramatic the changes were on any given day, this can cause rate changes throughout the day, as well as on the rate sheets we start with each morning. As you can see in the chart below, roller coaster trading in the markets continues. I’ll continue to monitor this situation closely. Chart: Fannie Mae 3.5% Mortgage Bond (Friday Feb 24, 2012)

|

| The Mortgage Market Guide View… |

| 7 Ways to Say Thanks

It’s hard to go through the day without hearing the words “thank you” or “thanks.” However, much of the time, people say those words quickly and without much meaning. Sure, a quick “thanks” is appropriate when someone holds a door for you or hands you something. But when it comes to saying thank you to a client, partner, or friend for a more significant gesture, it’s important to go the extra mile. This is even more crucial in today’s business environment when success is so dependent on personal connections. So how do demonstrate your appreciation? Here are 7 ways to say thank you…to strengthen your relationships…and to stand out in the mind of the person you’re thanking. 1. Classic and Classy. Mailing thank you notes has dwindled in today’s email business environment. That means you can really stand out and demonstrate your sincere appreciation by hand writing a brief thank you note and mailing it. Not sure what to write? No problem. Check out this simple advice for writing a thank you note. 2. A Little Surprise. Little surprises can be a fun way to thank a client, colleague, or friend. You may want to write a thank you note, but then slip it into a file that you hand the person. Or you could consider getting the person’s jacket for them when they get ready to leave a meeting…and then slip the note into a pocket just before you hand it to him or her. 3. See You in the Papers. If you have a newsletter, social media page or blog, thank people publicly. A short “shout out” can go a long way. 4. Phone a Friend. There’s something about hearing a person’s voice…and it’s even better when they call just to say thank you rather than to ask for something. 5. Face-to-Face. Dropping by to say thank you goes a long way to demonstrating your sincerity and to strengthening your relationships. 6. Time Is On Your Side. People seem busier than ever. That’s why making time for someone means so much. One way to thank a person is simply to schedule some time for coffee or to chat. Then, turn off your cell phone and give him or her your undivided attention. 7. A Good Cause. Sometimes it’s not appropriate to give money or a gift. That’s ok. You may find that a unique and sincere gesture is to make a donation to a worthy cause that the person cares about. Then, let the person know about your donation as a way of saying thanks. Economic Calendar for the Week of February 27 – March 02

|

|

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors.

|